Friday, December 30, 2005

A new year begins

After being down more than $4,000 earlier today, my portfolio managed to claw back to near break-even for the day. Although I still finished the week in the minus column (down 0.3 percent), this was better than S&P 500 (down 1.6 percent), the NASDAQ (down 2 percent), and the Russell 2000 (down 1.9 percent).

For the year as a whole, my portfolio performed exceedingly well, much better than I had expected and quite frankly, much better than it I am likely to do over the coming years. I know many people like to set goals for what sort of return on their portfolio they hope to achieve. I don't believe in doing that because I think there are too many things in the stock market that are outside my control. All I can do is work hard, do solid research into potentially winning trades and investments, and continue to innovate.

The latter is particularly important. I have said before, and I will say again, that I think the value based strategy that has worked so well for me over the past 5 years is slowly running its course. Don't get me wrong, I believe that over the long haul, investing in value stocks will yield superior returns than investing a broad index fund. However, value investing isn't the only way to make money. In fact, historically, a strategy based on momentum (buying stocks that have been winners over the past year and selling stocks that have been losers over the past year) has fared much better than any other investment strategy, including value based investing. I will write more about this issue in another post (and give you some solid empirical evidence to back up this assertion), but for the time being, suffice to say that in 2006, you will see a more holistic and broad based investing strategy from me than you saw in 2005.

This will also include a bit more trading, something that I am more comfortable with now than I was in the past. To this end, I have moved quite a lot of money from my Ameritrade account to my Scottrade account over the course of this year, which will allow me to trade more cheaply (Ameritrade charges $11 per trade, while Scottrade charges $7). While I won't become a daytrader (and indeed, I could not become a daytrader since I have a full time job which does not allow me to check my portfolio more than once or twice per day), I think a few more well-selected trades could supercharge my returns.

For the year as a whole, my portfolio performed exceedingly well, much better than I had expected and quite frankly, much better than it I am likely to do over the coming years. I know many people like to set goals for what sort of return on their portfolio they hope to achieve. I don't believe in doing that because I think there are too many things in the stock market that are outside my control. All I can do is work hard, do solid research into potentially winning trades and investments, and continue to innovate.

The latter is particularly important. I have said before, and I will say again, that I think the value based strategy that has worked so well for me over the past 5 years is slowly running its course. Don't get me wrong, I believe that over the long haul, investing in value stocks will yield superior returns than investing a broad index fund. However, value investing isn't the only way to make money. In fact, historically, a strategy based on momentum (buying stocks that have been winners over the past year and selling stocks that have been losers over the past year) has fared much better than any other investment strategy, including value based investing. I will write more about this issue in another post (and give you some solid empirical evidence to back up this assertion), but for the time being, suffice to say that in 2006, you will see a more holistic and broad based investing strategy from me than you saw in 2005.

This will also include a bit more trading, something that I am more comfortable with now than I was in the past. To this end, I have moved quite a lot of money from my Ameritrade account to my Scottrade account over the course of this year, which will allow me to trade more cheaply (Ameritrade charges $11 per trade, while Scottrade charges $7). While I won't become a daytrader (and indeed, I could not become a daytrader since I have a full time job which does not allow me to check my portfolio more than once or twice per day), I think a few more well-selected trades could supercharge my returns.

Thursday, December 29, 2005

Santa leaves coal in my portfolio

Down about $700 today. Looks like there won't be a Santa Clause rally this year. I guess people are still scared by how poorly stocks performed last January and have chosen to stay on the sidelines. I'm still above 600K. It will be a pity if I can't hold that level tomorrow, the last trading day of the year.

Wednesday, December 28, 2005

Do you MIND?

Up about $1,600 today. I picked up an additonal 3,000 shares of Mind CTI. MNDO is just too cheap at these levels. I think there is a good chance that the stock will have a nice January after the tax loss selling stops in the next few days.

Tuesday, December 27, 2005

Technical analysis on trial

Despite a nice move in APN, my portfolio floundered today with the rest of the market, falling by about $2,800.

I recently came across an interesting survey article on the evidence for the effectiveness of technical analysis. Of the 92 modern studies of TA cited in the survey, 58 found positive results regarding technical analysis. Mind you, many of the papers suffered from methodological problems, including the failure to model transaction costs (commissions and bid/ask spreads) and possible data mining. Data mining (or data snooping as it’s sometimes called) is particularly important because if you take a large enough data set, you will always find some data patterns that appear non-random. To illustrate this point, think about what happens when you take the square root of 2. The resulting number (1.4142….) is an irrational number (i.e. the sequence of numbers after the decimal point never repeat). If you were to assign A=1, B=2,… Z=26, you would eventually find a complete sequence of numbers in the number 1.4142... that unerringly and in the proper order spell out the complete text of the bible (in mathematics, there is a world of difference between a very big number and an infinite one). Does that mean that there is something magical about the square root of 2? Of course not!

In the context of technical analysis, if you backtest enough patterns, you will find that some yield consistently profitable trades (and indeed, it is these patterns that are likely to become popular and be cited by adherents of technical analysis). Thus, it is crucial to test any ostensibly profitable trading rule using out-of-sample data (data different from the one used to identify the rule). When one does this, it often appears that trading rules that are profitable in one time period cease to be profitable in the following time period. Indeed, the authors of the article concluded that technical trading rules ceased to be profitable for U.S. stocks after the late 1980’s. Perhaps this is because their increased use neutralized their efficacy? It’s hard to say. However, Andrew Lo’s description of the stock market as an evolutionary mechanism in which the profitability of various trading rules is always changing appears to hold much truth.

Nevertheless, I am impressed that at least some of the studies covered by this survey article did isolate trading rules that yielded extremely large annualized returns (over 200 percent annualized in some cases). This may suggest that there are some profitable technical trading rules out there that still waiting to be discovered. Of course, the only problem is that once they are discovered and disseminated to the broader public, they may cease to exist. In the meantime, it seems like the only consistent way to make money using technical analysis is to write a newsletter on the subject!

p.s. Thank you to the person who left a comment telling me that the original version of this post actually used a rational number (2/7) and not an irrational one (egg on my face!!!)

I recently came across an interesting survey article on the evidence for the effectiveness of technical analysis. Of the 92 modern studies of TA cited in the survey, 58 found positive results regarding technical analysis. Mind you, many of the papers suffered from methodological problems, including the failure to model transaction costs (commissions and bid/ask spreads) and possible data mining. Data mining (or data snooping as it’s sometimes called) is particularly important because if you take a large enough data set, you will always find some data patterns that appear non-random. To illustrate this point, think about what happens when you take the square root of 2. The resulting number (1.4142….) is an irrational number (i.e. the sequence of numbers after the decimal point never repeat). If you were to assign A=1, B=2,… Z=26, you would eventually find a complete sequence of numbers in the number 1.4142... that unerringly and in the proper order spell out the complete text of the bible (in mathematics, there is a world of difference between a very big number and an infinite one). Does that mean that there is something magical about the square root of 2? Of course not!

In the context of technical analysis, if you backtest enough patterns, you will find that some yield consistently profitable trades (and indeed, it is these patterns that are likely to become popular and be cited by adherents of technical analysis). Thus, it is crucial to test any ostensibly profitable trading rule using out-of-sample data (data different from the one used to identify the rule). When one does this, it often appears that trading rules that are profitable in one time period cease to be profitable in the following time period. Indeed, the authors of the article concluded that technical trading rules ceased to be profitable for U.S. stocks after the late 1980’s. Perhaps this is because their increased use neutralized their efficacy? It’s hard to say. However, Andrew Lo’s description of the stock market as an evolutionary mechanism in which the profitability of various trading rules is always changing appears to hold much truth.

Nevertheless, I am impressed that at least some of the studies covered by this survey article did isolate trading rules that yielded extremely large annualized returns (over 200 percent annualized in some cases). This may suggest that there are some profitable technical trading rules out there that still waiting to be discovered. Of course, the only problem is that once they are discovered and disseminated to the broader public, they may cease to exist. In the meantime, it seems like the only consistent way to make money using technical analysis is to write a newsletter on the subject!

p.s. Thank you to the person who left a comment telling me that the original version of this post actually used a rational number (2/7) and not an irrational one (egg on my face!!!)

Friday, December 23, 2005

Merry Christmas!

After a rough start to the week, my portfolio rebounded over the past 3 days, finishing the week up $1.984 (0.3 percent), slightly better than the S&P 500 (up 0.1 percent) and the NASDAQ (down 0.1 percent) but not quite as good as the Russell 2000 (up 0.5 percent).

Next week should be interesting. Typically, this is the time of year that hedge fund managers and daytraders who have had a bad year get desperate and start taking risky bets, often in the realm of microcap stocks. Last year, my portfolio surged almost 10 percent in the last week of December, largely due to a massive pump and dump in the stock of Taylor "the Tsunami Stock" Devices. While I doubt that next week will bring comparable gains, I am certain that many of my positions will experience volatility, so it should be a bumpy ride to say the least. Merry Christmas everyone and my best wishes to you and your families over the holiday weekend.

Next week should be interesting. Typically, this is the time of year that hedge fund managers and daytraders who have had a bad year get desperate and start taking risky bets, often in the realm of microcap stocks. Last year, my portfolio surged almost 10 percent in the last week of December, largely due to a massive pump and dump in the stock of Taylor "the Tsunami Stock" Devices. While I doubt that next week will bring comparable gains, I am certain that many of my positions will experience volatility, so it should be a bumpy ride to say the least. Merry Christmas everyone and my best wishes to you and your families over the holiday weekend.

Thursday, December 22, 2005

Kentucky Fried Investors

Up about $2,100 today. I have a new position to disclose: it's Kentucky Investors Group (KINV.OB). The company is profitable, pays a dividend, has had a fair bit of insider buying, and is trading at less than 60 percent of tangible book value. In other words, it's cheap; dare I say: finger-licking cheap?

The stock is very illiquid. Indeed, it took me two weeks and two partial fill orders before I could buy 500 shares at $23.61. Thus, if you go out and buy it (which I strongly discourage), please use a limit order or you might end up buying the stock from me!

The stock is very illiquid. Indeed, it took me two weeks and two partial fill orders before I could buy 500 shares at $23.61. Thus, if you go out and buy it (which I strongly discourage), please use a limit order or you might end up buying the stock from me!

Wednesday, December 21, 2005

Fun with TASR

I probably should stop watching CNBC in the mornings. Every time I do, I end up thinking I've just spotted a great daytrading opportunity. Well, today I couldn't resist and bought 1000 shares of Taser. I must admit I am a bit embarrassed about this. I suppose it's partly a reflection of the stigma that daytrading carries.

I remember watching a 20/20 episode last year about obesity. The show featured one guy who weighed over 500 pounds and was so fat that he couldn't leave his house and had to "resort" to daytrading to make a living. They didn't say if he was making any money, but obviously he wasn't starving to death (cluck cluck cluck).

Mind you, as Terrance Odean and other academics have shown, most daytraders do lose money over the long haul. However, I also recall reading a working paper last year (whose title and author I don't recall) which demonstrated that among that those elite daytraders who do make money, they make money consistently, which empirically can't be said for mutual fund managers (statistically, superior mutual fund performance reverts to the mean very quickly).

Anyhow, it was a decent day today as my portfolio gained about $4,100. And as far as the TASR trade was concerned, it went reasonably well. I put in a market order to buy at the open. It was filled at $6.60 per share (although Yahoo Finance shows that the opening price was $6.56..go figure) I checked on my portfolio at lunch and noticed that TASR and the rest of the market were rolling over from their highs, so I sold my TASR position for a respectable 24 cent per share gain.

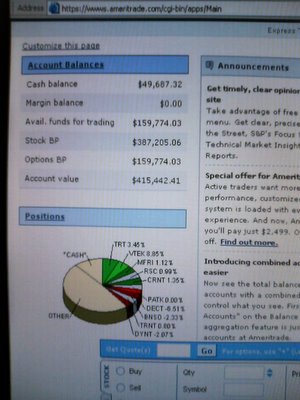

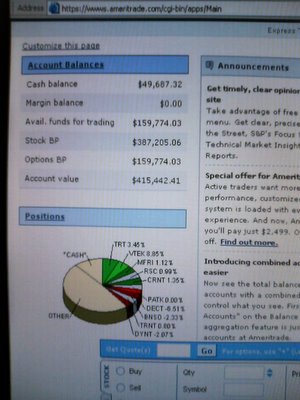

Finally, for all you jokers who are leaving comments and sending me emails who think I make up my results, here's a bit of proof (though I'm sure it still won't satisfy the sceptics):

I remember watching a 20/20 episode last year about obesity. The show featured one guy who weighed over 500 pounds and was so fat that he couldn't leave his house and had to "resort" to daytrading to make a living. They didn't say if he was making any money, but obviously he wasn't starving to death (cluck cluck cluck).

Mind you, as Terrance Odean and other academics have shown, most daytraders do lose money over the long haul. However, I also recall reading a working paper last year (whose title and author I don't recall) which demonstrated that among that those elite daytraders who do make money, they make money consistently, which empirically can't be said for mutual fund managers (statistically, superior mutual fund performance reverts to the mean very quickly).

Anyhow, it was a decent day today as my portfolio gained about $4,100. And as far as the TASR trade was concerned, it went reasonably well. I put in a market order to buy at the open. It was filled at $6.60 per share (although Yahoo Finance shows that the opening price was $6.56..go figure) I checked on my portfolio at lunch and noticed that TASR and the rest of the market were rolling over from their highs, so I sold my TASR position for a respectable 24 cent per share gain.

Finally, for all you jokers who are leaving comments and sending me emails who think I make up my results, here's a bit of proof (though I'm sure it still won't satisfy the sceptics):

Tuesday, December 20, 2005

Up against the ropes

Down about $3,900. Not good. Not good at all. Since last Thursday, my portfolio has fallen every single day, and is now down more than $8,000. Mind you, that's only about 1.5 percent of my total portfolio, but it still feels like ALOT of money. Heck, it is a lot of money, especially when you figure that five and a half years ago, when I was still studying at university, my net worth was less than that.

Anyhow... You have probably noticed that there is a Google Adsense ad at the top of the page (Google owns Blogger.com so it only took about 2 minutes to enrol in the program). I don't expect to make much money off these ads, but I still thought it would be fun to give them a whirl. Needless to say, I don't endorse any of the stuff that is being sold. And speaking of which, I don't know if you are seeing the same ad that I'm seeing, but I'm currently seeing an ad hyping the stock of GTXC. Here's a fun test: go to their website and read their press releases. If your first response is "Wow..their technology sure is intriguing" then I suggest you find yourself a very nice index fund and forget about picking your own stocks. If your response is "Wow.. I'd really love to short this stock", then welcome to the savage world of microcap investing!

Anyhow... You have probably noticed that there is a Google Adsense ad at the top of the page (Google owns Blogger.com so it only took about 2 minutes to enrol in the program). I don't expect to make much money off these ads, but I still thought it would be fun to give them a whirl. Needless to say, I don't endorse any of the stuff that is being sold. And speaking of which, I don't know if you are seeing the same ad that I'm seeing, but I'm currently seeing an ad hyping the stock of GTXC. Here's a fun test: go to their website and read their press releases. If your first response is "Wow..their technology sure is intriguing" then I suggest you find yourself a very nice index fund and forget about picking your own stocks. If your response is "Wow.. I'd really love to short this stock", then welcome to the savage world of microcap investing!

Monday, December 19, 2005

Bad CALL

Down about $3,000 today. Blah. Why is it that every time I sell some shares in COBR (I'm now down to only 540 shares), it always goes up the next day but when I consider selling CALL but then decide against it, it goes down the next day?

Friday, December 16, 2005

Who needs liquidity?

Although my portfolio declined about $1,300 today, I finished the week up $5,565 (0.9 percent), slightly better than the S&P 500 (up 0.6 percent), but considerably better than the NASDAQ (down 0.2 percent) and Russell 2000 (down 0.8 percent). This is also the first week that my portfolio has closed above the $600 K level.

Occasionally I get emails that mention that my style of investing suffers from a major problem: I tend to invest in very illiquid stocks, which implies that if the market tumbles, I would have difficulty liquidating my positions.

I must admit, I don't quite buy this argument. First of all, I am not sure why I would want to liquidate my positions if the market tumbles (wouldn't my shares be cheaper and more undervalued then?). The liquidity argument is perfectly valid for daytraders and market-timers, but I'm neither. Second, even though I do invest in illiquid stocks, they are not that illiquid. Although it's true that sometimes it takes me days if not weeks to build a position, that's largely because I tend to set limit orders at or below the bid price, hoping that someone will catch the bait. Third, illiquidity can be a good thing since it often spawns volatility, and volatility allows you to buy low when the stock is temporarily depressed and sell high when the stock temporarily surges. As long as you have a well diversified portfolio (as I do), volatility is nothing to fear. Fourth, there is a substantial academic literature showing that over time, the rate of appreciation of illiquid stocks exceeds those of their liquid cousins. This is true even if one conditions on market capitalization, so this premium exists above and beyond the familiar premium that the market rewards to small cap stocks. As always, your comments on my observations are very welcome.

Occasionally I get emails that mention that my style of investing suffers from a major problem: I tend to invest in very illiquid stocks, which implies that if the market tumbles, I would have difficulty liquidating my positions.

I must admit, I don't quite buy this argument. First of all, I am not sure why I would want to liquidate my positions if the market tumbles (wouldn't my shares be cheaper and more undervalued then?). The liquidity argument is perfectly valid for daytraders and market-timers, but I'm neither. Second, even though I do invest in illiquid stocks, they are not that illiquid. Although it's true that sometimes it takes me days if not weeks to build a position, that's largely because I tend to set limit orders at or below the bid price, hoping that someone will catch the bait. Third, illiquidity can be a good thing since it often spawns volatility, and volatility allows you to buy low when the stock is temporarily depressed and sell high when the stock temporarily surges. As long as you have a well diversified portfolio (as I do), volatility is nothing to fear. Fourth, there is a substantial academic literature showing that over time, the rate of appreciation of illiquid stocks exceeds those of their liquid cousins. This is true even if one conditions on market capitalization, so this premium exists above and beyond the familiar premium that the market rewards to small cap stocks. As always, your comments on my observations are very welcome.

Wednesday, December 14, 2005

Cobra keeps it up

Up $2,000 thanks to a nice move in COBR. Although I appreciate today's action in COBR, I am annoyed by the fact that I only have 1140 shares left, down from 4,000 shares, most of which I sold at much lower prices. However, knowing when to sell is much more difficult than knowing when to buy. A stock can go much higher than one anticipates, and conversely, a rally can fizzle out almost immediately, even when a company has solid fundamentals and reports good news. One can sell too early or one can sell too late, but it's virtually impossible to sell at exactly the perfect time. Indeed, a stock rally is a lot like sex: it feels best right before it ends.

MFRI reported a decent quarter after the close. The numbers weren't spectacular, but considering that the stock is sitting close to it's 52 week low, I think it should see some upside in the days and weeks ahead. DECT will also be reporting tomorrow. My gut tells me that the numbers will be good. I have 3,000 shares of DECT, having topped up my position last week.

MFRI reported a decent quarter after the close. The numbers weren't spectacular, but considering that the stock is sitting close to it's 52 week low, I think it should see some upside in the days and weeks ahead. DECT will also be reporting tomorrow. My gut tells me that the numbers will be good. I have 3,000 shares of DECT, having topped up my position last week.

Tuesday, December 13, 2005

Pipe dream

Up $1,100 yesterday and another $1,200 today. Although this performance is decent, it should have been better. I fumbled the ball twice. First fumble: DAIO. I had been stalking this stock for several weeks but somehow never managed to get my buy limit order filled. The stock moved higher last week and then exploded on Monday (though it gave back some of that gain today). Oh well.

Second fumble: TAYD. The stock moved sharply higher this morning after the company announced a big contract (big by TAYD's standards at least; about one quarter's worth of revenue). Although I took some shares off the table at $4.15, I kept most of them. Turns out this was a mistake. The stock moved as high as $4.86 and then drifted back below $4. Should have made more money. Oh well (again).

Anyhow, I have a new position to reveal. The stock is MFRI. The company manufacturers pipes and other boring things. It's trading just below book value and only about 20 percent of revenue. The company is profitable, though sales growth has been week and frankly, there has been more dilution in the stock than I would like. Nevertheless, I think the risk reward calculation is favorable. I'm in for 2,500 shares at $5.30.

Second fumble: TAYD. The stock moved sharply higher this morning after the company announced a big contract (big by TAYD's standards at least; about one quarter's worth of revenue). Although I took some shares off the table at $4.15, I kept most of them. Turns out this was a mistake. The stock moved as high as $4.86 and then drifted back below $4. Should have made more money. Oh well (again).

Anyhow, I have a new position to reveal. The stock is MFRI. The company manufacturers pipes and other boring things. It's trading just below book value and only about 20 percent of revenue. The company is profitable, though sales growth has been week and frankly, there has been more dilution in the stock than I would like. Nevertheless, I think the risk reward calculation is favorable. I'm in for 2,500 shares at $5.30.

Friday, December 09, 2005

I put some MARS in my shopping cart

Well, the week is over and it's time to tally the results. My portfoio ended up gaining $3,136 (0.5 percent), which compares favorably with the S&P 500 (down 0.5 percent), NASDAQ (down 0.7 percent), and Russell 2000 (down 0.3 percent).

I picked up 1,000 shares of Marsh Supermarkets (ticker MARSB, MARSA is also available). The company recently announced that it has put itself up for sale, and has hired Merrill Lynch to assist them. Although the company's business is struggling, the stock is training at a very low multiple to revenue (even by grocery chain standards) and below tangible book value. I think when the sale occurs, the selling price will be at a decent premium to where the stock is currently trading.

I picked up 1,000 shares of Marsh Supermarkets (ticker MARSB, MARSA is also available). The company recently announced that it has put itself up for sale, and has hired Merrill Lynch to assist them. Although the company's business is struggling, the stock is training at a very low multiple to revenue (even by grocery chain standards) and below tangible book value. I think when the sale occurs, the selling price will be at a decent premium to where the stock is currently trading.

Thursday, December 08, 2005

Took some profits in DLPX

Up about $1,400 today. I sold 2,000 shares (half my position) of DLPX at $3.19 (at what turned out to be the high for the day, which has got to be a first for me). In retrospect, I'm not sure if that was a good idea. Looking back at the day's chart, I'm impressed by how well the stock held its ground. I think that's a bullish sign so I wouldn't be surprised if DLPX went to $4 by the end of next week.

However, I'm trying not to be greedy. A 45 percent return in two days is nothing to sneeze at. Besides, I am still peeved about Bozo (umm.. I mean Bonso). I bought 2,500 shares at $4.20, the stock went up to $7, and now it's back to exactly where I bought it, and I never sold a single share. Gotta take profits along the way. Like Cramer says, bulls make money, bears make money, but pigs get slaughtered. Speaking of which, I don't think I've watched Cramer's show for 2 months now. Am I the only one who quickly got bored of his shtick?

However, I'm trying not to be greedy. A 45 percent return in two days is nothing to sneeze at. Besides, I am still peeved about Bozo (umm.. I mean Bonso). I bought 2,500 shares at $4.20, the stock went up to $7, and now it's back to exactly where I bought it, and I never sold a single share. Gotta take profits along the way. Like Cramer says, bulls make money, bears make money, but pigs get slaughtered. Speaking of which, I don't think I've watched Cramer's show for 2 months now. Am I the only one who quickly got bored of his shtick?

Wednesday, December 07, 2005

Nice one, DLPX

Up about $400 today thanks to nice moves in ACSEF, PATK, and VII. DLPX reported a decent quarter after the close. Although revenue was up only slightly from the quarter a year earlier, earnings were up sharply. Hopefully the daytraders will run this one up tomorrow!

Tuesday, December 06, 2005

DLPX

Despite a nice move in FRSH on news that the company was being bought out, my portfolio struggled today, finishing down about $500. I picked up 4,000 shares of Delphax (DLPX). The company's business has been going sideways for several years now, but the they continue to boast nice gross margins and the stock is trading below tangible book value and close to its 52 week low. The company reports earnings tomorrow so I may be cruising for a bruising by buying now. However, I think even if the numbers aren't great, there is limited downside risk in owning this stock and frankly, limited downside risk is an appealing concept when you're investing in a market that is as overbought as this one.

Monday, December 05, 2005

Return of the garbage stocks

Up about $200 today. Well, I ran my stockscreener this weekend, and the results were very disappointing. Although I was able to add a few more stocks to my watch list, on the whole, I found very little that interested me. Indeed, it is hard to escape the conclusion that this is a very bad time to be a value investor. A few years ago, solid companies with great prospects trading at low levels of price to earnings and price to book were easy to find. Now such companies are virtually non-existent.

With a few exceptions, the only companies that are trading at a discount to their tangible book value are companies teetering on the verge of bankruptcy or whose prospects are otherwise extremely dim. Indeed, I am amazed by the sheer number of garbage stocks that have managed to rise from the trash heap to assume market capitalizations much higher than they deserve.

What to do? Well, I think a sensible strategy is to short some of these garbage stocks. And with that in mind, I would like to ask my readers to suggest some stocks that would make good short candidates. Please send me an email or better yet, leave a comment so that other readers of this blog can benefit from your opinion.

With a few exceptions, the only companies that are trading at a discount to their tangible book value are companies teetering on the verge of bankruptcy or whose prospects are otherwise extremely dim. Indeed, I am amazed by the sheer number of garbage stocks that have managed to rise from the trash heap to assume market capitalizations much higher than they deserve.

What to do? Well, I think a sensible strategy is to short some of these garbage stocks. And with that in mind, I would like to ask my readers to suggest some stocks that would make good short candidates. Please send me an email or better yet, leave a comment so that other readers of this blog can benefit from your opinion.

Saturday, December 03, 2005

Weekly summary

Up another $5,000 or so on Friday to finish the week up $5,853 (1 percent), better than the NASDAQ (up 0.5 percent) and the S&P 500 (down 0.2 percent) but on par with the Russell 2000 (also up 1 percent). I would like to thank all the people who contacted me with their thoughts, some of which were extremely comprehensive and insightful, on stocks that they regard as undervalued. I will research your ideas further, and run some stock screens this weekend so that I can further refine my watch list.

Friday, December 02, 2005

Clueless

Up about $5,000 today. A reader left a comment wondering if I knew what was up with Yi Wan holdings. To be honest, I don't know. Although I only have 10,000 shares of the stock, it's down about 40 percent from where I bought it, so needless to say, I am not pleased. If anyone knows why their quarterly report was delayed or anything else that's relevant about the company, please let me know.

And speaking of being clueless, I'm sitting on a big cash position right now and frankly, I don't have many good ideas about how to deploy it. I'll try to run some stock screens over the weekend, but if any of you have good ideas about stocks that fit my investment profile, again, please let me know. Basically, I'm looking for candidate stocks that: i) have a market cap under $500 million; ii) are not trading very far above their 52 week lows; iii) have insider buying; iv) have strong balance sheets, preferably with net asset value above market cap; v) have improving fundamentals (growing revenues, increased profitability); and vi) are fully reporting to the SEC. Obviously, few stocks will perfectly fit that profile, but the closer the better.

And speaking of being clueless, I'm sitting on a big cash position right now and frankly, I don't have many good ideas about how to deploy it. I'll try to run some stock screens over the weekend, but if any of you have good ideas about stocks that fit my investment profile, again, please let me know. Basically, I'm looking for candidate stocks that: i) have a market cap under $500 million; ii) are not trading very far above their 52 week lows; iii) have insider buying; iv) have strong balance sheets, preferably with net asset value above market cap; v) have improving fundamentals (growing revenues, increased profitability); and vi) are fully reporting to the SEC. Obviously, few stocks will perfectly fit that profile, but the closer the better.