Friday, April 28, 2006

ACSEF's Big Adventure

My portfolio gained $17,099 (2.3 percent) this week, outpacing the S&P 500 (down 0.1 percent), the NASDAQ (down 0.9 percent), and the Russell 2000 (down 1.0 percent). For April, my portfolio gained $46,949 (6.7 percent).

Most of the gains this week were attributable to a single stock: ACSEF, which surged over 100 percent on Wednesday. I had 2500 shares of ACSEF. I sold 1350 shares at the open on Thursday (I literally slept through all the action on Wednesday; just as well since I probably would have sold too early if I had been watching).

Actually, I got skunked by the market markets at the open on Thursday. The stock was quoted at $10.40 just before 9:30, and then all of a sudden the MM's marked it down to $10, which turned out to be the opening print. The stock then proceeded to make a quick move to $11 before giving back some of its gains. I hate it when that happens (though it serves me right, should have used a limit order). Anyway, I'll hang on to the other shares for the time being. I don't want to be greedy but then again, I don't want to miss out if the stock move higher, as I think it may.

In other news, I sold my remaining 250 shares of AE at (almost) the 52 week high. However, now that I said that, I'm sure the stock will be at $50 in few days. I also continue to buy more shares of OCCF and EWEB. I think I'm the only one buying. That's okay, I guess I'll be the only one to make serious money off these positions. Over and out.

Most of the gains this week were attributable to a single stock: ACSEF, which surged over 100 percent on Wednesday. I had 2500 shares of ACSEF. I sold 1350 shares at the open on Thursday (I literally slept through all the action on Wednesday; just as well since I probably would have sold too early if I had been watching).

Actually, I got skunked by the market markets at the open on Thursday. The stock was quoted at $10.40 just before 9:30, and then all of a sudden the MM's marked it down to $10, which turned out to be the opening print. The stock then proceeded to make a quick move to $11 before giving back some of its gains. I hate it when that happens (though it serves me right, should have used a limit order). Anyway, I'll hang on to the other shares for the time being. I don't want to be greedy but then again, I don't want to miss out if the stock move higher, as I think it may.

In other news, I sold my remaining 250 shares of AE at (almost) the 52 week high. However, now that I said that, I'm sure the stock will be at $50 in few days. I also continue to buy more shares of OCCF and EWEB. I think I'm the only one buying. That's okay, I guess I'll be the only one to make serious money off these positions. Over and out.

Saturday, April 22, 2006

Traveling

It was another solid week for my portfolio. The portfolio gained $19,544 (2.7 percent) for the week, outperforming the S&P 500 (up 1.7 percent) and the NASDAQ (up 0.7). However, I slightly lagged the Russell 2000 (up 2.8 percent). I will be traveling on business in Asia for the next three weeks so I won't be blogging regularly. However, I will try to update the blog whenever something particularly interesting happens.

Thursday, April 20, 2006

Suspicious checkout for Marsh

Up less than 0.1 percent today. I had a feeling something was afoot with MARSA/B over the past few days. It looked like someone knew something and was loading up before an impending announcement. And whadda ya know? Marsh announced after the close that they were being bought out by a private equity firm. Will the SEC investigate? I doubt it. Unfortunately, this sort of insider trading is more common than most people realize in the microcap world.

Anyway, I'll be glad to be rid of the stock. At one point, I was down more than 10K on this position, so I'm relieved to be getting out for a reasonable profit. However, considering Sun Capital isn't pay a premium to today's closing price, I'd be lying if I said I wasn't disappointed. I was thinking a buyout price of about $15 was more reasonable. Mind you, the sale hasn't been finalized yet, but I figure considering the large number of shares that are held by company insiders, it's virtually a done deal.

Anyway, I'll be glad to be rid of the stock. At one point, I was down more than 10K on this position, so I'm relieved to be getting out for a reasonable profit. However, considering Sun Capital isn't pay a premium to today's closing price, I'd be lying if I said I wasn't disappointed. I was thinking a buyout price of about $15 was more reasonable. Mind you, the sale hasn't been finalized yet, but I figure considering the large number of shares that are held by company insiders, it's virtually a done deal.

Wednesday, April 19, 2006

More OCCF

Up 1.1 percent today. A reader asks if I am still long and strong AE, which at one time was one of my largest positions. I must confess that I screwed up a bit. I sold most of my shares when the stock was still in the twenties. I'm still holding 250 shares, but obviously, I'd be happier (and wealthier) if I didn't sell so soon.

I am realizing that one thing I need to do better is follow industry trends more closely. Case in point: MFRI. I sold that stock too soon because I didn't realize how much of a bull market there was in pipes.

With all this in mind, I bought 1300 more shares of OCCF. Fiber optic stocks are red hot now and I think OCCF should benefit from this favorable industry trend.

I am realizing that one thing I need to do better is follow industry trends more closely. Case in point: MFRI. I sold that stock too soon because I didn't realize how much of a bull market there was in pipes.

With all this in mind, I bought 1300 more shares of OCCF. Fiber optic stocks are red hot now and I think OCCF should benefit from this favorable industry trend.

Tuesday, April 18, 2006

How can you compete with that?

The markets were up huge today. Not surprisingly, my portfolio lagged behind: up only 0.6 percent. I bought back 2000 shares of PEAK that I sold a month or so ago in the mid $3 range. Unless their next earnings report sucks, I think this stock will go back up.

Monday, April 17, 2006

Tax Time

Ah, the joy of taxes. I just depleted what was once a very large bank account balance to pay my taxes for 2005. Chances are that next year I'll have to liquidate some of my holdings to cover the tax bill for this year. Oh well, such is life.

Anyway, this week began on a solid footing as my portfolio gained 0.5 percent today thanks in large part to nice gains in the MARS Brothers (MARSA and MARSB). I also noticed that after the close one of my watch list stocks, RML, got bought out by Warren Buffet. Even though I don't own RML, it's nice to know that the Great One and I are looking at the same stocks!

Anyway, this week began on a solid footing as my portfolio gained 0.5 percent today thanks in large part to nice gains in the MARS Brothers (MARSA and MARSB). I also noticed that after the close one of my watch list stocks, RML, got bought out by Warren Buffet. Even though I don't own RML, it's nice to know that the Great One and I are looking at the same stocks!

Thursday, April 13, 2006

Weekly Summary

In relative terms, it was another successful week. My portfolio gained $1,376 (0.2 percent), outperforming the S&P 500 (down 0.5 percent), the NASDAQ (down 0.6 percent), and the Russell 2000 (down 0.7 percent).

Like any good investor, I'm always asking myself what I should have done better in the past and what I should do better in the future. One thing that I should have done better, but didn't, is focus more on picking stocks in hot industries. Although I have had some exposure to the energy and materials sectors, in retrospect, it is clear that I should have weighted these sectors more heavily.

What that in mind, I picked up 6000 shares of Pine Valley Mining (PVMCF.OB) at $1.41 this morning. It's a Canadian company. Unlike most smaller Canadian natural resource companies, this one trades on the TSE. Admittedly, the company has had plenty of problems. However, all four analysts that follow it (Bay Street analysts I presume) rate it a buy or strong buy. Although earnings estimates have been knocked down several times, the company still trades at about 5 times forward earnings. However, what appeals to me most is that the company controls a huge about of coal reserves that have yet to be tapped. I'm also told that Fox News regular Tobin Smith is bullish about this stock. I'm not sure if that's a good thing, however.

Like any good investor, I'm always asking myself what I should have done better in the past and what I should do better in the future. One thing that I should have done better, but didn't, is focus more on picking stocks in hot industries. Although I have had some exposure to the energy and materials sectors, in retrospect, it is clear that I should have weighted these sectors more heavily.

What that in mind, I picked up 6000 shares of Pine Valley Mining (PVMCF.OB) at $1.41 this morning. It's a Canadian company. Unlike most smaller Canadian natural resource companies, this one trades on the TSE. Admittedly, the company has had plenty of problems. However, all four analysts that follow it (Bay Street analysts I presume) rate it a buy or strong buy. Although earnings estimates have been knocked down several times, the company still trades at about 5 times forward earnings. However, what appeals to me most is that the company controls a huge about of coal reserves that have yet to be tapped. I'm also told that Fox News regular Tobin Smith is bullish about this stock. I'm not sure if that's a good thing, however.

Wednesday, April 12, 2006

Trying to catch the PXPL knife

Up 0.6 percent today. Well, so much for my intention to refrain from starting new positions; I started a new position in Pixelplus (PXPL) this morning. Actually, I was hoping it would turn out to be a profitable daytrade. It looked that way initially: I picked up 1500 shares at $4.19 and immediately placed a sell order at $4.91. Unfortunately, although the stock did move up from my buy point, it didn't get much past $4.35 all day.

There's a lot to dislike about PXPL (lawsuit, accounting restatement, lowered guidance, etc.) However, the company's market cap is only slightly above its cash value. Moreover, the company still has some semblance of viable business and is operating in a hot sector. I'll give this one a bit more rope; I think there is a good chance the stock will rebound to $5 within the next few tradings days.

I forgot to mention yesterday that I sold TOA for a tiny profit. I still like the company but judging from the profusion of 'for sale' signs in my neighborhood, this is definitely not the right time to be owning a housing stock.

There's a lot to dislike about PXPL (lawsuit, accounting restatement, lowered guidance, etc.) However, the company's market cap is only slightly above its cash value. Moreover, the company still has some semblance of viable business and is operating in a hot sector. I'll give this one a bit more rope; I think there is a good chance the stock will rebound to $5 within the next few tradings days.

I forgot to mention yesterday that I sold TOA for a tiny profit. I still like the company but judging from the profusion of 'for sale' signs in my neighborhood, this is definitely not the right time to be owning a housing stock.

Tuesday, April 11, 2006

Your head, sir?

Down 0.2 percent yesterday and down another 0.3 percent today. Last week John Hussman wrote something quite interesting that I had suspected, but didn't have much data to collaborate:

Among stocks belonging to the S&P 500, those rated “A” or “highest quality” have gained just 1.01% year-to-date. In contrast, companies rated “B -” or “lower quality” have gained 10.17% year-to-date. At the bottom of the quality barrel, those S&P 500 companies rated “C” or “D” for “lowest quality” (or in reorganization) have gained a striking 16.90% year-to-date. The pattern is the same in the Russell 2000, where the highest, lower, and lowest quality stocks in the index have posted average year-to-date gains of 7.38%, 13.03% and 20.09%, respectively....One need not predict an abrupt end to this low-quality rally to recognize that it's dangerously mature. Over the past 3 years, the average price/revenue and price/book ratios of the lowest quality stocks have virtually doubled (from 1.26 to 2.57 times revenues, and from 1.67 to 3.15 times book value). In contrast, the valuations of the highest quality stocks have remained constant or actually decreased (from 2.16 to 2.17 times revenues, and from 3.95 to 3.64 times book value).

If the past few days are any indication, small cap investors are getting their heads handed back to them. So far my portfolio is holding up reasonably well, in relative terms anyway. However, I am very aware that my portfolio isn't exactly...umm...shall we say.. stacked with blue chips. So for now, to be on the safe side, I'm going to get a bit defensive and refrain from making any purchases until the dust has settled.

Friday, April 07, 2006

Weekly Summary + 2 new stocks

Despite naughty price action from the likes of CBTE and VTEK, my portfolio managed to escape today's smallcap meltdown unscathed. Indeed, I actually gained 0.2 percent for the day. For the week, my portfolio gained $8,931 (1.3 percent), outperforming the Russell 2000 (down 1.2 percent), S&P 500 (up 0.1 percent), and the NASDAQ (flat).

I did end up buying more shares of diamond merchant LKI (the mystery hidden gem I mentioned yesterday...get it...gem?). I thought the earnings report was pretty good. I now hold a total of 2000 shares in the company. I also started a new position in SCOP (2000 shares). Considering the market in which this company operates, its solid earnings and revenue growth, and healthy cash position, this stock is about as undervalued as it gets. The only reason I didn't buy more shares is because the stock seems to fall out of bed every morning to a new 52 week low, and I hate betting against that sort of downward momentum. Once it stablizes, I'll build a full position of around 5000 shares.

I did end up buying more shares of diamond merchant LKI (the mystery hidden gem I mentioned yesterday...get it...gem?). I thought the earnings report was pretty good. I now hold a total of 2000 shares in the company. I also started a new position in SCOP (2000 shares). Considering the market in which this company operates, its solid earnings and revenue growth, and healthy cash position, this stock is about as undervalued as it gets. The only reason I didn't buy more shares is because the stock seems to fall out of bed every morning to a new 52 week low, and I hate betting against that sort of downward momentum. Once it stablizes, I'll build a full position of around 5000 shares.

Thursday, April 06, 2006

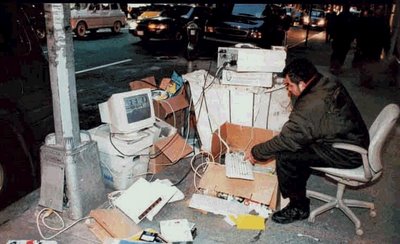

The reality of daytrading

Hidden Gem?

Up 0.6 percent yesterday and another 0.5 percent today. I picked up some shares of a company that will be reporting earnings tomorrow morning. I'll reveal the name in tomorrow's post because it's a very illiquid stock and I may want to pick up a few more shares if the numbers are good.

Tuesday, April 04, 2006

Other worthwhile blogs

Another sleepy day for the 'ol portfolio: up 0.1 percent. You will notice on the left hand side of your screen a section called "Stock blogs I like". Given my schedule, I don't read too many blogs, although there is a small handful that I read on an almost daily basis. I would like to add a few more blogs that try to do what I do: report positions held and performance over time. I haven't found too many blogs like that. Most bloggers provide commentary and stock picks, which is fine. But let's face, commentary and stock picks aren't exactly in short supply. You can get that any time of the day on CNBC. People like Dehtrader, Charles Kirk, and Solitaire Trader, who have the courage to let others know whether their picks are making any money, on the other hand, are more rare. If you are aware of other blogs like mine, please let me know.