Friday, July 28, 2006

Weekly Summary: Could have done better

My portfolio gained 0.6 today to finish the week up $15,588 (2.2 percent). Not bad, but not as good as the major indices. For the week, the S&P 500 gained 3.1 percent, the NASDAQ gained 3.7 percent, and the Russell 2000 gained 4.2 percent. With one more trading day remaining in July, I again find myself in the unenviable position of trailing the S&P 500 for the third month in a row.

Well, I was spectacularly wrong about NTGR. Instead of opening up a few percentage points above my buy price, the stock opened 10 percentage points below my buy price! Partly this was on account of some clown analyst who downgraded it this morning. Fortunately, the stock managed to muster a bit of a comeback and the limit order that I placed to sell the stock at $18.98 got filled. So in the end I lost 26 cents per share on the trade (plus a $10 round trip commission with Ameritrade Izone). I suspect NTGR may go higher on Monday, but when a trade goes this badly off course, I am not one to push my luck. Live and learn.

I also sold most of my shares in PXPL (for a big loss). The stock spiked this morning after some guy who won MSN's stock picking contest recommended it. This is the second stock this month that he recommended that happened to be in my portfolio (the other was CHCI). I wish I could move the markets like that! (Of course, if my words could cause a stock to spike 30 percent, I would just end up selling the stock back to anyone who is foolish enough to buy it. Hey, at least I'm honest!). Anyway, hopefully his recommendation next week will be DYNT (my largest position).

I am going to be on vacation next week so I probably won't post to the blog unless something really momentous happens. I should be back the following week. Have a great week everyone!!!!!!!

Well, I was spectacularly wrong about NTGR. Instead of opening up a few percentage points above my buy price, the stock opened 10 percentage points below my buy price! Partly this was on account of some clown analyst who downgraded it this morning. Fortunately, the stock managed to muster a bit of a comeback and the limit order that I placed to sell the stock at $18.98 got filled. So in the end I lost 26 cents per share on the trade (plus a $10 round trip commission with Ameritrade Izone). I suspect NTGR may go higher on Monday, but when a trade goes this badly off course, I am not one to push my luck. Live and learn.

I also sold most of my shares in PXPL (for a big loss). The stock spiked this morning after some guy who won MSN's stock picking contest recommended it. This is the second stock this month that he recommended that happened to be in my portfolio (the other was CHCI). I wish I could move the markets like that! (Of course, if my words could cause a stock to spike 30 percent, I would just end up selling the stock back to anyone who is foolish enough to buy it. Hey, at least I'm honest!). Anyway, hopefully his recommendation next week will be DYNT (my largest position).

I am going to be on vacation next week so I probably won't post to the blog unless something really momentous happens. I should be back the following week. Have a great week everyone!!!!!!!

Thursday, July 27, 2006

Baseball and NTGR

Down 0.2 percent today. Learning to trade well is a lot like learning to bat well in baseball. To bat well, you have to practise a lot and you have to learn from your mistakes. You also need to know when to swing and when to hold back. Trading is the same. I don't really believe in mechanical trading systems because they overlook the important element of intuition. And I believe that intuition, gained from years of practise and introspection, is what makes a good trader great.

Because I have a full time job (which I enjoy very much), I don't have much time to follow the stock market during the course of the day. But that doesn't mean I can't continue to practise. A few weeks ago I started doing the following exercise: after the market closed, I would look at the NASDAQ most active page to see what stocks were either moving up or down in afterhours trading. I would then focus in on one or two stocks, and try to predict where these stocks would open the following morning. I find this exercise useful in honing my predictive powers. My predictions are often wrong, but of course the nice thing about trading is that you can still make lots of money even if you are wrong 40 percent of the time. Today I decided to put some money on the line. I bought 500 shares of NTGR at $19.24. My not-so-expert opinion is that the stock will open between $19.50 and $20. Let's see if I'm right!

Because I have a full time job (which I enjoy very much), I don't have much time to follow the stock market during the course of the day. But that doesn't mean I can't continue to practise. A few weeks ago I started doing the following exercise: after the market closed, I would look at the NASDAQ most active page to see what stocks were either moving up or down in afterhours trading. I would then focus in on one or two stocks, and try to predict where these stocks would open the following morning. I find this exercise useful in honing my predictive powers. My predictions are often wrong, but of course the nice thing about trading is that you can still make lots of money even if you are wrong 40 percent of the time. Today I decided to put some money on the line. I bought 500 shares of NTGR at $19.24. My not-so-expert opinion is that the stock will open between $19.50 and $20. Let's see if I'm right!

Wednesday, July 26, 2006

Hotel California

Up 0.5 percent today. I was having trouble falling asleep last night. Lying in bed, I started thinking to myself what I would do if I got so rich that I didn't need to trade any more or so poor that I couldn't afford to trade. I realized that I either way I could never leave the game. If I blew it all, I would just sweat it out until I could raise new capital to put back into the market. And if I got super rich, I still wouldn't cash my chips, at least not all of them. I think the title of Cramer's first book, "Confessions of a Street Addict" says it all. Trading is an addiction. A very strong addiction. It really is Hotel California from the Eagles' song: You can check out any time you like, but you can never leave. So really the choice for me is not whether to quit trading or keep trading; rather the choice is whether I make money or lose money. Knowing this makes me realize that I need to continue to work hard to reach the top of my game. Does anyone else feel the same way?

Tuesday, July 25, 2006

Blast from the Past

Up 0.9 percent today. I started a new position in ENPT. It's a small position (5000 shares). I dated the stock back in 2003 and made some good money on it. The stock is more expensive now but the fundamentals are also better, so I think there is good risk/reward here. Unless the market collapses or the company's fundamentals deteriorate, I figure the stock will eventually reach book value, which would be over $2 per share.

Monday, July 24, 2006

Left behind

Markets up 2 percent. Stockcoach up 0.3 percent. My stocks just get no respect.

Friday, July 21, 2006

Weekly Summary: Down but not out

Well, no surprise, I got my ass kicked today. For the week, my portfolio declined 1.5 percent, underperforming the S&P 500 (up 0.3 percent), the NASDAQ (down 0.8 percent), and the Russell 2000 (down 1.4 percent).

There's an old adage that says "what doesn't kill you can only make you stronger". I'm taking this little proverb to heart in relation to my less than successful foray into the mid-cap and large-cap areas of the market. It took me several years before I could successfully trade small cap stocks. Honestly, much of the lessons earned can't be written down on paper. It's more of a gut feeling that one develops from years of experience that tells you which stock to pick, and when to get in and out. Obviously, some of the lessons that I learned can be applied to the large cap realm, but my no means all of them. There are some critical differences, and I have become much more attuned to them. In the past two weeks, I've had the chance to see these stocks move in relation to my expectations. While I've lost money in the process, I've also gained valuable lessons, and I think these lessons will begin to pay big dividends down the road. I'm excited about the future, and I think my portfolio will begin to show it.

There's an old adage that says "what doesn't kill you can only make you stronger". I'm taking this little proverb to heart in relation to my less than successful foray into the mid-cap and large-cap areas of the market. It took me several years before I could successfully trade small cap stocks. Honestly, much of the lessons earned can't be written down on paper. It's more of a gut feeling that one develops from years of experience that tells you which stock to pick, and when to get in and out. Obviously, some of the lessons that I learned can be applied to the large cap realm, but my no means all of them. There are some critical differences, and I have become much more attuned to them. In the past two weeks, I've had the chance to see these stocks move in relation to my expectations. While I've lost money in the process, I've also gained valuable lessons, and I think these lessons will begin to pay big dividends down the road. I'm excited about the future, and I think my portfolio will begin to show it.

Thursday, July 20, 2006

BroadCON

Down 0.6 percent, but that doesn't take into account Broadcon's debacle after the market closed. I bought that piece of garbage at over $30 and I'll be lucky if it opens above $24 tomorrow. To make matters worse, I bought some MRVL today thinking that good earnings from Apple and Motorola last night would help rally that stock. Wrong! MRVL is also down big afterhours.

So far my little foray into large caps has been a disaster. The fact that I'm down on all my large cap positions would be tolerable given the state of the market, but the reality is that I would have been much better off if I had just bought large cap indices like the QQQQ or SPY. I think from now on I will just try to trade large caps, as opposed to investing in them. With that in mind, I bought 25 shares of Googlygoog at $382 afterhours. I've already put in my market order to sell at the open tomorrow.

So far my little foray into large caps has been a disaster. The fact that I'm down on all my large cap positions would be tolerable given the state of the market, but the reality is that I would have been much better off if I had just bought large cap indices like the QQQQ or SPY. I think from now on I will just try to trade large caps, as opposed to investing in them. With that in mind, I bought 25 shares of Googlygoog at $382 afterhours. I've already put in my market order to sell at the open tomorrow.

Wednesday, July 19, 2006

Rebound

My portfolio rebounded with the rest of the market, although as is typical on big days like today, I lagged the indices, with my portfolio gaining only 1.2 percent.

Tuesday, July 18, 2006

I own Yahoo for my charitable trust

Not! I'm glad I got out of that POS a few weeks ago (for an ugly $2000 loss). Anyway, it was another sucky day today. My portfolio declined 0.6 percent. Most of my small craps either went sideways or down. Oh well.

In reference to KTCC, a reader left a comment asking me how I determined my sale price. Basically, when I sell a stock I base that decision on the stock's fundamentals (what I think the company worth based on its earnings and balance sheet). I typically scale out of a position slowly (like I did with KTCC). I also take into account the overall market environment. If this were a better market, I probably would have given KTCC more rope, but it's not. I also try to do a half-assed job of gauging where a stock may be "technically oversold" to give me a sense of where I should sell. Since I don't know much about technical analysis (and don't really believe it it anyway), usually this exercise does more harm than good.

In reference to KTCC, a reader left a comment asking me how I determined my sale price. Basically, when I sell a stock I base that decision on the stock's fundamentals (what I think the company worth based on its earnings and balance sheet). I typically scale out of a position slowly (like I did with KTCC). I also take into account the overall market environment. If this were a better market, I probably would have given KTCC more rope, but it's not. I also try to do a half-assed job of gauging where a stock may be "technically oversold" to give me a sense of where I should sell. Since I don't know much about technical analysis (and don't really believe it it anyway), usually this exercise does more harm than good.

Monday, July 17, 2006

Tough day for oil drillers

The portfolio was down 0.7 today partly on account of PDC and NBR. Both stocks sank after some clown downgraded the group this morning. The only bright spot was IFO. Hopefully the portfolio will do better the rest of the week.

Friday, July 14, 2006

Weekly Summary: Relatively Good

If you had asked me last week to predict which three stocks would help my portfolio the most this week, KTCC, CRWS and MAM would have been close to the bottom of the list. Yet, they were the stars of my portfolio, with KTCC gaining over 50 percent, CRWS surging over 200 percent, and MAM moving up a healthy 30 percent. Unfortunately, none of these stocks were large positions, but they did help to keep me in plus column, quite an achievement considering how badly the markets fared this week.

For the week, my portfolio gained $1,210 (0.2 percent), handily outperforming the S&P 500 (down 2.3 percent), the NASDAQ (down 4.4 percent), and the Russell 2000 (down 4.0 percent).

I sold my shares in AE yesterday. The stock has move up 10 smackers since I bought it a few weeks ago (this was my second ride on the AE express this year). I still love the stock's fundamentals, but I'd rather avoid being too greedy in this market.

For the week, my portfolio gained $1,210 (0.2 percent), handily outperforming the S&P 500 (down 2.3 percent), the NASDAQ (down 4.4 percent), and the Russell 2000 (down 4.0 percent).

I sold my shares in AE yesterday. The stock has move up 10 smackers since I bought it a few weeks ago (this was my second ride on the AE express this year). I still love the stock's fundamentals, but I'd rather avoid being too greedy in this market.

Wednesday, July 12, 2006

CRWS explodes

Up 0.6 percent today. If memory serves me right, I have been holding CRWS for nearly 3 years now and during that time, the stock has done absolutely nothing. Until today, that is. Today the stock surged 150 percent after the company announced that it has taken steps to shore up its balance sheet, and in the process dramatically reduce the fully diluted share count. Unfortunately, I opened the position a long time ago when my portfolio was substantially smaller, so as of today I only had 5000 shares to my name. Still, the move helped drown out what otherwise would have been a lackluster day. (Long time readers of this blog may be puzzled as to why I am talking about stock. As it turns out, I had accidentally neglected to enter it in my positions list and never noticed the omission until today).

In other news, I finally said goodbye to my remaining 1000 shares of KTCC. My standing limit order got filled at $7.21 today, a fortuitous exit since this was close to the high on the day. I've had a great time with the contract manufacturing stocks over the past year (WSCI, SMTX, and of course KTCC). The only one that hasn't hit my price target is NSYS, but hopefully that will happen soon.

In other news, I finally said goodbye to my remaining 1000 shares of KTCC. My standing limit order got filled at $7.21 today, a fortuitous exit since this was close to the high on the day. I've had a great time with the contract manufacturing stocks over the past year (WSCI, SMTX, and of course KTCC). The only one that hasn't hit my price target is NSYS, but hopefully that will happen soon.

Tuesday, July 11, 2006

IFO and NBR

Up 0.3 percent today. Just my luck. I sold most of my KTCC shares yesterday and not only did the stock hold its gains today, it closed the day near an all time high. The stock now has $7 written all over it.

For the third time in two weeks, I'm back in IFO, picking up 1000 shares at $6.96 today. I also started a new position in NBR (600 shares at $32.70). The stock is trading at less than 10 times earnings and analysts expect the company to grow earnings by nearly 40 percent annually over next 5 years. I want some more energy sector exposure, and I think this is the right stock for that.

Lastly, I'm restating my results for yesterday. Due to an error in recording the gains from the KTCC afterhours trade, the portfolio was actually up 0.1 percent yesterday, and not 0.5 percent as I had reported. No class action lawsuits, please.

For the third time in two weeks, I'm back in IFO, picking up 1000 shares at $6.96 today. I also started a new position in NBR (600 shares at $32.70). The stock is trading at less than 10 times earnings and analysts expect the company to grow earnings by nearly 40 percent annually over next 5 years. I want some more energy sector exposure, and I think this is the right stock for that.

Lastly, I'm restating my results for yesterday. Due to an error in recording the gains from the KTCC afterhours trade, the portfolio was actually up 0.1 percent yesterday, and not 0.5 percent as I had reported. No class action lawsuits, please.

Monday, July 10, 2006

Thanks KTCC

My portfolio gained 0.5 percent today mainly on account of KTCC. The stock surged afterhours after the company raised guidance for the coming quarter. At one point last year, KTCC was my biggest position (over 10,000 shares). However, as of today, I was down to only 2700 shares, 1700 of which I sold for $6 tonight. On a fundamentals basis, I think the stock is still worth closer to $8 but the stock has a nasty habit of selling off after spiking on good news, so hopefully I will be able to buy back the shares I sold tonight at a lower price than where I sold them.

Friday, July 07, 2006

Weekly Summary

Not a good week to start the second half of the year. The portfolio fell $4,384 (0.6 percent), underperforming the S$P 500 (down 0.4 percent) but better than than either the NASDAQ (down 1.9 percent) and the Russell 2000 (also down 1.9 percent).

I sold all my shares in CHCI. The stock moved sharply higher today. As best as I can gather, the stock surged today because some columnist on MSN recommended it. Whatever. If that's not a good reason to sell, I don't know what is. I'll repurchase it if it goes back to $6.

I also sold most of my LTON shares. Scratch what I said yesterday. With the newly revised rules governing SMS providers in China, this stock is dead money for the foreseeable future.

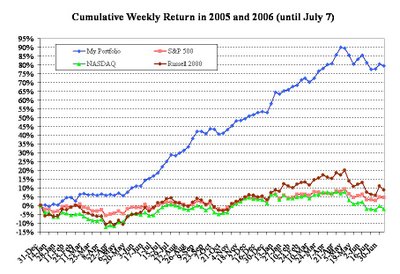

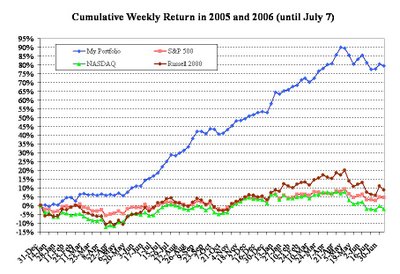

I've also uploaded the updated charts. Hopefully that nasty trend since April in the chart below will reverse itself soon. Have a great weekend everyone!

I sold all my shares in CHCI. The stock moved sharply higher today. As best as I can gather, the stock surged today because some columnist on MSN recommended it. Whatever. If that's not a good reason to sell, I don't know what is. I'll repurchase it if it goes back to $6.

I also sold most of my LTON shares. Scratch what I said yesterday. With the newly revised rules governing SMS providers in China, this stock is dead money for the foreseeable future.

I've also uploaded the updated charts. Hopefully that nasty trend since April in the chart below will reverse itself soon. Have a great weekend everyone!

Thursday, July 06, 2006

IFO, MRVL, and ACSEF

The portfolio has been stagnant so far this week. Down about 0.5 percent through to today. My entry in IFO couldn't have been better. I bought 1050 shares at $5.97 late last week. The stock surged 20 percent yesterday. I decided to sell my position at the open this morning. Bad move. I got filled at $7.30 and the stock proceeded to move higher, much higher, going all the way past $9. Oh well. I did try the same stunt early last week with IFO and I got the timing perfect: in at $5.98, out at $6.40 the next morning.

I bought 400 shares of MRVL yesterday thinking that Cramer, upon his return from his vacation, would trumpet it. Wrong move. He panned it. I managed to still get out for a $1 per share profit when the stock moved higher today but I don't think I'll touch it again for some time. I'm still holding BRCM. The stock has a PEG ratio of 0.83. That's pretty cheap for a best of breed stock. I think I'll hold it into earnings and see what happens.

More closer to my value stock home, I also doubled up on ASCEF (basically repurchasing the shares I sold at $10 back in late April). The stock is too cheap to pass up at these levels.

The rest of my portfoio isn't doing much. PXPL and LTON are hurting me but I think both will rebound.

I bought 400 shares of MRVL yesterday thinking that Cramer, upon his return from his vacation, would trumpet it. Wrong move. He panned it. I managed to still get out for a $1 per share profit when the stock moved higher today but I don't think I'll touch it again for some time. I'm still holding BRCM. The stock has a PEG ratio of 0.83. That's pretty cheap for a best of breed stock. I think I'll hold it into earnings and see what happens.

More closer to my value stock home, I also doubled up on ASCEF (basically repurchasing the shares I sold at $10 back in late April). The stock is too cheap to pass up at these levels.

The rest of my portfoio isn't doing much. PXPL and LTON are hurting me but I think both will rebound.