Friday, September 29, 2006

And from the imaginary Yahoo! Finance message board...

hahahahaha.. I told you STKC was a POS but you stupid longs wouldn’t listen. Horrible results. It’s not too late to get out longs. I’m not covering my short till we are under a dollar.

In Play: Stockcoach (STKC) reports third quarter results

5:52PM STKC third quarter profits down 57 percent. Lowers guidance: now expects full year profits down 15-25 percent compared to earlier projection of increase of 5 to 10 percent.

Stockcoach Reports Third Quarter Results

Third quarter profits of $45,643

Outperforms benchmark Russell 2000 by 5.9 percent during quarter

Updates full year guidance

Stockcoach (Nasdog: STKC) today announced profits of $45,643 for the third quarter of 2006 compared to profits of $106,629 for the third quarter of 2005, a decrease of 57 percent. For the nine months ending September 30, 2006, profits declined 7 percent to $153,893, compared to $166,258 the first nine months of 2005. Stockcoach’s equity was $756,136 at the of the third quarter.

“I am pleased to report another profitable quarter,” said Mr. Stockcoach, President, janitor, and tea boy at Stockcoach, Inc. “This marks the ninth consecutive quarter that I have outperformed the S&P 500, Nasdaq, and the benchmark Russell 2000 index.”

Mr. Stockcoach continued, “At the beginning of this year, I had targeted to increase profits by 5 to 10 percent over last year’s levels. However, the past six months have been a difficult time for smallcap stocks, and particularly for the sort of microcap stocks that represent the bulk of my portfolio. Although I have been able outperform the markets, the rate of appreciation of my portfolio has fallen well below historic norms. Consequently, I now expect 2006 profits to be 15 to 25 percent below 2005 levels. While this is disappointing, I remain confident that my basic investment strategy can deliver higher profits in the years ahead for all my shareholders (me, myself, and I).

Monday, September 25, 2006

New Record High

The portfolio gained 1.1 percent today to a new record high thanks almost entirely to a single stock: SPPI. The stock rocketed up 45 percent today on word of positive results from Phase III trials of one of the drugs in its pipeline. I have 4000 shares of SPPI and I didn't sell a single share. I think the stock has $7 written all over it.

I also said goodbye to an old favorite today: TRT. I sold my remaining 1000 shares today. I think the stock still has great technical mojo, but frankly, upon further reflection, the quarter that they reported on Friday just wasn't as stupendous as traders seem to think it is. For one thing, almost half the profit was not from operations. And for another thing, the company didn't pay any tax during the quarter (and indeed earned a small tax benefit). Having left $7000 on the table by not selling all my ASCEF shares when they were trading above $10, I'm reluctant to make the same mistake again.

I also said goodbye to an old favorite today: TRT. I sold my remaining 1000 shares today. I think the stock still has great technical mojo, but frankly, upon further reflection, the quarter that they reported on Friday just wasn't as stupendous as traders seem to think it is. For one thing, almost half the profit was not from operations. And for another thing, the company didn't pay any tax during the quarter (and indeed earned a small tax benefit). Having left $7000 on the table by not selling all my ASCEF shares when they were trading above $10, I'm reluctant to make the same mistake again.

Friday, September 22, 2006

Weekly Summary: Trio-ing to make some money

Trio-Tech's 50 percent surge helped to keep me in the plus column for day. Although I sold half my position early in the day to lock in some gains, I am impressed by how well the stock was able to consolidate its gains and even make a new 52 week high towards the close. Thanks to TRT, ACSEF, CPAK, and a few other stocks in my portfolio, it turned out to be a good week, especially in relative terms. For the week, my portfolio gained $8,296 (1.1 percent), which compares favorably with the NASDAQ (down 0.7 percent), S&P 500 (down 0.4 percent), and the Russell 2000 (down 1.5 percent).

I also started a new position: EGR. With oil prices coming down, I think this energy retailer may stand to benefit. Also, Daniel Zeff, who happens to be one sagacious money manager, has been snapping up shares of this little company. If it's good enough for the Zeffy, it's good enough for me.

I also started a new position: EGR. With oil prices coming down, I think this energy retailer may stand to benefit. Also, Daniel Zeff, who happens to be one sagacious money manager, has been snapping up shares of this little company. If it's good enough for the Zeffy, it's good enough for me.

Wednesday, September 20, 2006

Shameful

The portfolio managed to gain only 0.1 percent today. EWEB is finally showing a bit of muscle, but all my other major positions are sucking wind.

Tuesday, September 19, 2006

Yahoo and Thailand scare the market

The market got hit hard this morning on Yahoo's warning, apparently stemming in part from weaker than expected advertising on its finance site (considering how many Yahoo message boards have become shadows of their former selves after the new format was introduced, that's not too surprising). To make matters worse, news that there had been a coup in Thailand rattled the markets with memories of July 2, 1997 (at least for those traders old enough to remember that date). When I checked on my portfolio at lunch, I was down 1 percent. Fortunately, the market rallied and my portfolio was able to recover some of those losses and I ended up closing down 0.3 percent for the day.

Monday, September 18, 2006

Thanks TST

The portflio gained 0.6 percent today thanks partly to a continued nice move in shares of TST on news that the company will be moving from the AMEX to the NASDAQ.

A reader asks if my long and short positions all represent currrent holdings. The answer is yes. All the positions listed are stocks that I currently own. However, there are a few stocks that I currently own but have not listed on the blog because I am trying to buy more shares and naturally, I don't want any extra competition for my order.

A reader asks if my long and short positions all represent currrent holdings. The answer is yes. All the positions listed are stocks that I currently own. However, there are a few stocks that I currently own but have not listed on the blog because I am trying to buy more shares and naturally, I don't want any extra competition for my order.

Saturday, September 16, 2006

Weekly Summary: Lackluster

It was a lackluster week for my portfolio. My portfolio gained 7R to the power of pi multiplied by the cosmological constant, all divided by the square root of three rabbits. Or for all you non-traders out there, 1.0 percent ($7,402).

As I've mentioned before, the historic patterns tends to be the following: large cap stocks make big gains, traders get more confident, and as they get more confident, they begin to put money into more speculative small cap and microcap stocks. If this patter continues to hold, then hopefully many of my stocks will begin to see price gains in the weeks ahead. That would certainly be a welcome development since it has now been 4 and a half months since my portfolio recorded a new high.

As I've mentioned before, the historic patterns tends to be the following: large cap stocks make big gains, traders get more confident, and as they get more confident, they begin to put money into more speculative small cap and microcap stocks. If this patter continues to hold, then hopefully many of my stocks will begin to see price gains in the weeks ahead. That would certainly be a welcome development since it has now been 4 and a half months since my portfolio recorded a new high.

Thursday, September 14, 2006

More on R

The portfolio was down 0.3 percent today. My post on the merits of R has spawned a lively debate in the comments section. First, let me say that I continue to have utmost respect for such traders like Trader Mike and Richard at Move the Markets who attest to the usefulness of R. These guys are talented, take their jobs seriously, and from what I can tell, they are both great traders.

However, at the end of the day, R still fails the “sniff test” for me. Let me put it this way: if a hedge fund manager told you he made 300R last year, would you be more likely or less likely to give him your money compared to a hedge fund manager who told you his fund returned 50 percent last year?

Fine, you say, R is not a great measure of performance, but at least it’s a good measure of risk. Again, I disagree. Suppose you go long a $10 stock. If you devote 50 percent of your capital to this trade and set a stop at $9, then your R is 5% (since at most you will lose 5 percent of your capital on the trade). Note, however, if you devote 10 percent of your capital but set a super wide stop at $5, your R is still 5% (because again, at most you will lose 5 percent of your capital on the trade).

Now I would argue that both trades are qualitatively and quantitatively different in terms of risk management. In particular, most traders who base their decisions on technical analysis would agree that anyone who allows a position to fall 50 percent before getting out has screwed up. Yet, both trades get the same R. For my money, a simple statement like “I risked x percent of my capital on GOOG, and made y percent on the trade” is a lot more informative.

However, at the end of the day, R still fails the “sniff test” for me. Let me put it this way: if a hedge fund manager told you he made 300R last year, would you be more likely or less likely to give him your money compared to a hedge fund manager who told you his fund returned 50 percent last year?

Fine, you say, R is not a great measure of performance, but at least it’s a good measure of risk. Again, I disagree. Suppose you go long a $10 stock. If you devote 50 percent of your capital to this trade and set a stop at $9, then your R is 5% (since at most you will lose 5 percent of your capital on the trade). Note, however, if you devote 10 percent of your capital but set a super wide stop at $5, your R is still 5% (because again, at most you will lose 5 percent of your capital on the trade).

Now I would argue that both trades are qualitatively and quantitatively different in terms of risk management. In particular, most traders who base their decisions on technical analysis would agree that anyone who allows a position to fall 50 percent before getting out has screwed up. Yet, both trades get the same R. For my money, a simple statement like “I risked x percent of my capital on GOOG, and made y percent on the trade” is a lot more informative.

Wednesday, September 13, 2006

Stick it up your R's

The portolio gained 1.0 percent today. I can’t recall when I first heard the term “R” but I do recall my initial reaction. It was a bit like what one’s reaction would be if your uncle Buck tried to “debunk” Einstein’s Special Theory of Relativity. You’d just smile and nod.

R is a measure of trading performance that tries to gauge one’s return relative to the amount of risk one takes. Specifically, R is how much you risk you assume on any given trade. Typically, R is defined as a percentage of one’s trading capital. So if you risk 1 percent of your capital on a trade and make a profit equal to 2 percent of your capital, you’ve made 2R.

But does this concept even make sense? Let’s ignore the rather unfortunate terminology (outside of trading, R has a very specific statistical meaning, that of a statistical coefficient). Let’s also ignore the fact that R has absolutely nothing to do with what financial economists would regard as risk: beta. Let’s just ask a simple question: does knowing “how many R’s one’s made over the course of a year” even tell you whether the person is making or losing money?

Consider the following example: Suppose Jim makes 1000 trades over the course of a year and risks 10 percent of his capital on each trade (R=10%). Naturally, Jim’s trading capital goes up or down depending on whether his last trade was profitable. Suppose that 520 trades turn out to be profitable and Jim earns 10% (1R) on each trade and 480 trades turn out to be unprofitable and Jim loses 10% (1R) on all those trades. Jim’s total R for the year is 520*R minus 480*R = 40R, which seems to imply he made a whopping 400 percent. Wow! Good job Jim! You’re almost as good as Trader Mike

But wait, what’s Jim’s actual cumulative percentage return? Well, that’s simple to calculate: it’s (1.1^520) times (0.9^480) = 0.36. So in reality, Jim has lost about 74 percent of his capital during the year. Oops, stick with that day job, Jim! Intuitively, the reason we get such divergent results is because it makes no sense to add up R's because if you lose 10 percent on a trade, you need more than 10 percent just to get back to break even.

R is a measure of trading performance that tries to gauge one’s return relative to the amount of risk one takes. Specifically, R is how much you risk you assume on any given trade. Typically, R is defined as a percentage of one’s trading capital. So if you risk 1 percent of your capital on a trade and make a profit equal to 2 percent of your capital, you’ve made 2R.

But does this concept even make sense? Let’s ignore the rather unfortunate terminology (outside of trading, R has a very specific statistical meaning, that of a statistical coefficient). Let’s also ignore the fact that R has absolutely nothing to do with what financial economists would regard as risk: beta. Let’s just ask a simple question: does knowing “how many R’s one’s made over the course of a year” even tell you whether the person is making or losing money?

Consider the following example: Suppose Jim makes 1000 trades over the course of a year and risks 10 percent of his capital on each trade (R=10%). Naturally, Jim’s trading capital goes up or down depending on whether his last trade was profitable. Suppose that 520 trades turn out to be profitable and Jim earns 10% (1R) on each trade and 480 trades turn out to be unprofitable and Jim loses 10% (1R) on all those trades. Jim’s total R for the year is 520*R minus 480*R = 40R, which seems to imply he made a whopping 400 percent. Wow! Good job Jim! You’re almost as good as Trader Mike

But wait, what’s Jim’s actual cumulative percentage return? Well, that’s simple to calculate: it’s (1.1^520) times (0.9^480) = 0.36. So in reality, Jim has lost about 74 percent of his capital during the year. Oops, stick with that day job, Jim! Intuitively, the reason we get such divergent results is because it makes no sense to add up R's because if you lose 10 percent on a trade, you need more than 10 percent just to get back to break even.

Tuesday, September 12, 2006

Left behind

Well, the Russell 2000 is up huge so far this week and I'm in the red! The portfolio fell 0.4 percent today and gained only 0.1 percent today. Hopefully the rest of the week will be better.

Monday, September 11, 2006

Hope and Remembrance

Friday, September 08, 2006

Weekly Summary: Not a good week

Well, I guess it was inevitable that I would have to take out "Big Red" #ff0000 to update the weekly results for the blog. It was not a good week to say the least, with the portfolio losing 1.7 percent of it's value.

The only transaction of significance this week was my sale of ACY. I've been holding this stock for over a year and it's almost doubled since then. The stock is still trading way below tangible book, but the company has lots of debt, and with interest rates going up, I was not to keen to hold this stock and risk watching my gains evaporate.

EWEB continues to be my "stockus horribilis" as the Her Royal Majesty might say. I guess it's times like these that I am glad I have a ironclad rule against having any one position worth more than 5 percent of my portfolio. Yeah, I feel stupid having first bought the stock when it was in the high 3's, but that's just the way it is. I still think there's a good chance I'll be vindicated. Have a great weekend everyone!

The only transaction of significance this week was my sale of ACY. I've been holding this stock for over a year and it's almost doubled since then. The stock is still trading way below tangible book, but the company has lots of debt, and with interest rates going up, I was not to keen to hold this stock and risk watching my gains evaporate.

EWEB continues to be my "stockus horribilis" as the Her Royal Majesty might say. I guess it's times like these that I am glad I have a ironclad rule against having any one position worth more than 5 percent of my portfolio. Yeah, I feel stupid having first bought the stock when it was in the high 3's, but that's just the way it is. I still think there's a good chance I'll be vindicated. Have a great weekend everyone!

Thursday, September 07, 2006

Suck

Down another 0.6 percent today. I'm now down 2 percent for the week. I know that's not huge in percentage terms, but it's still about $15 K, which is huge. Maybe that's because 6 years ago I was still a university student and 5 dollars seemed like a lot (wow, has it really been 6 years?). Actually, 5 dollars is still a lot of money to me so losing $15 K really does suck.

Wednesday, September 06, 2006

Bad day

Bad day, don't wanna talk about it, down 1.1 percent. Yeah, I know the market also tanked but I thought I had structured my portfolio so that I would have a sufficiently low beta and high enough alpha in order to escape days like today.

On a positive note, I would like to thank Quant Investor for his kind words about this blog. Keep up the great work, Quant!

On a positive note, I would like to thank Quant Investor for his kind words about this blog. Keep up the great work, Quant!

Tuesday, September 05, 2006

EWEB's latest bright idea

A lousy day today: down 0.3 percent, largely on account of EWEB. EWEB seems to want to reinvent itself on a monthly, if not weekly, basis. First it was an ISP. No wait, then it become an IT consulting company. No wait, then it became a real estate company. No wait, then it became a venture capital fund supplying money to semiconductor start-ups. All within the space of 3 months!!! I'm sure today's big discovery of oil in the Gulf will prompt the company to go into oil drilling!

Most investors now regard EWEB's management as one big giant clown show. I must admit I am inclined not to disagree, but at the same time, some perspective is in order. This is a company that was able to build a large ISP in Central Europe, and eventually sell if for $30 million. So I am willing to give EWEB a bit more slack, but I must admit, my patience is wearing thin. So far I've lost about $15 thousand on this stock, by far my biggest loss of the past two years. But for better or for worse, I refuse to bail on the company, a decision which I know may eventually come back to haunt me.

Most investors now regard EWEB's management as one big giant clown show. I must admit I am inclined not to disagree, but at the same time, some perspective is in order. This is a company that was able to build a large ISP in Central Europe, and eventually sell if for $30 million. So I am willing to give EWEB a bit more slack, but I must admit, my patience is wearing thin. So far I've lost about $15 thousand on this stock, by far my biggest loss of the past two years. But for better or for worse, I refuse to bail on the company, a decision which I know may eventually come back to haunt me.

Friday, September 01, 2006

Weekly Summary: Good, but not good enough

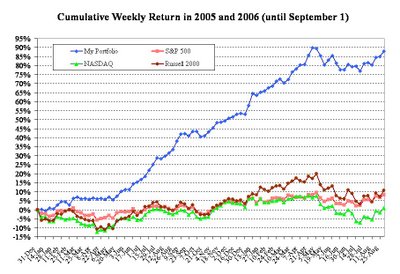

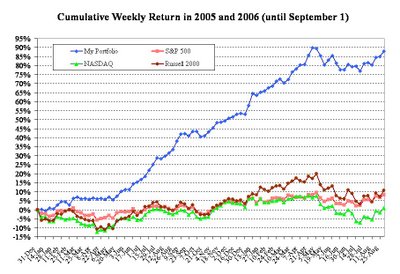

My portfolio gained $11,295 (1.6 percent) this week. While that's nice money any way you slice it, I did underperform both the Nasdaq and the Russell 2000 this week and also for the month of August. There is certainly truth to the old adage that a rising tide lifts all boats. As the graph below illustrates, my portfolio has continued to recover along with the rest of the market and is now only 1 percent off its all time high. Still, the days when I was beating the major indices on average by 5 percent per month seem to be a distant memory. Obviously, that's a margin of victory that would have been nearly impossible to maintain indefinitely in any case. Nevertheless, I am determined to keep working hard to ensure that I outperform the markets on a sustained basis. Have a great weekend everyone!