Wednesday, December 21, 2005

Fun with TASR

I probably should stop watching CNBC in the mornings. Every time I do, I end up thinking I've just spotted a great daytrading opportunity. Well, today I couldn't resist and bought 1000 shares of Taser. I must admit I am a bit embarrassed about this. I suppose it's partly a reflection of the stigma that daytrading carries.

I remember watching a 20/20 episode last year about obesity. The show featured one guy who weighed over 500 pounds and was so fat that he couldn't leave his house and had to "resort" to daytrading to make a living. They didn't say if he was making any money, but obviously he wasn't starving to death (cluck cluck cluck).

Mind you, as Terrance Odean and other academics have shown, most daytraders do lose money over the long haul. However, I also recall reading a working paper last year (whose title and author I don't recall) which demonstrated that among that those elite daytraders who do make money, they make money consistently, which empirically can't be said for mutual fund managers (statistically, superior mutual fund performance reverts to the mean very quickly).

Anyhow, it was a decent day today as my portfolio gained about $4,100. And as far as the TASR trade was concerned, it went reasonably well. I put in a market order to buy at the open. It was filled at $6.60 per share (although Yahoo Finance shows that the opening price was $6.56..go figure) I checked on my portfolio at lunch and noticed that TASR and the rest of the market were rolling over from their highs, so I sold my TASR position for a respectable 24 cent per share gain.

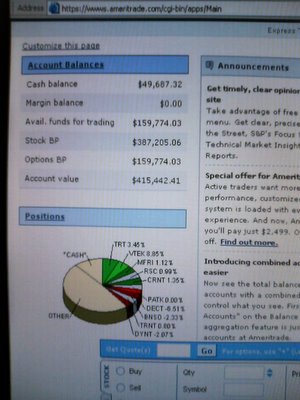

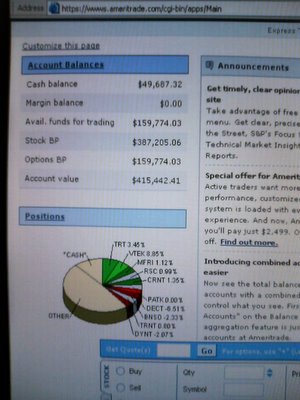

Finally, for all you jokers who are leaving comments and sending me emails who think I make up my results, here's a bit of proof (though I'm sure it still won't satisfy the sceptics):

I remember watching a 20/20 episode last year about obesity. The show featured one guy who weighed over 500 pounds and was so fat that he couldn't leave his house and had to "resort" to daytrading to make a living. They didn't say if he was making any money, but obviously he wasn't starving to death (cluck cluck cluck).

Mind you, as Terrance Odean and other academics have shown, most daytraders do lose money over the long haul. However, I also recall reading a working paper last year (whose title and author I don't recall) which demonstrated that among that those elite daytraders who do make money, they make money consistently, which empirically can't be said for mutual fund managers (statistically, superior mutual fund performance reverts to the mean very quickly).

Anyhow, it was a decent day today as my portfolio gained about $4,100. And as far as the TASR trade was concerned, it went reasonably well. I put in a market order to buy at the open. It was filled at $6.60 per share (although Yahoo Finance shows that the opening price was $6.56..go figure) I checked on my portfolio at lunch and noticed that TASR and the rest of the market were rolling over from their highs, so I sold my TASR position for a respectable 24 cent per share gain.

Finally, for all you jokers who are leaving comments and sending me emails who think I make up my results, here's a bit of proof (though I'm sure it still won't satisfy the sceptics):

Comments:

<< Home

I don't doubt your account performance. More importantly, that is not why I come to this blog. I am here to read your interesting blog.

How do you compute the overall return rate when you add cash into your account over time? what tool do you use? thanks.

How do you compute the overall return rate when you add cash into your account over time? what tool do you use? thanks.

I just use a simple Excel spreadsheet. Adding money has no impact on the rate of return. Every month, I calculate the rate of return by taking the change in my portfolio minus any cash deposits and dividing by the value of my portfolio at the beginning of the month.

I believe your results based on the high quality of your blog posts. Your honesty shines through.

Keep up the good work, and don't get discouraged by the doubters.

As your account grows, it will be tougher to keep up your rate of return buying only micro-caps. Have you thought about adding another investment style to your repertoire?

Keep up the good work, and don't get discouraged by the doubters.

As your account grows, it will be tougher to keep up your rate of return buying only micro-caps. Have you thought about adding another investment style to your repertoire?

I interned at a hedge fund in downtown Chicago last summer in which I spent a few weeks checking out the company's day trading operations. One of my responsibilities was tracking the P/Ls of individual traders. Through my tenure, I found that the company has a 90% turnover rate for day traders (90% get fired in less then 2 years). A good 50% of them were just arbing currencies and most seemed to be flat, slightly up, or slightly down.

Among them was one 24 year old who was up 5 million for the year, single-handedly canceling out the losses of all of the other employees, and putting them well into the black.

Basically, the firm cycles through hundreds of applicants, trying to find more stars like him.

Over the two weeks I tracked his P&L, he never had a losing day (and was pulling in about $10,000-30,000 a day).

He traded the 30 year bond and nothing but it. His average gain per trade was one third of a tick.

I'd say your assessment is probably correct. It seems there are a few hawks that accumulate the loses of the masses.

Among them was one 24 year old who was up 5 million for the year, single-handedly canceling out the losses of all of the other employees, and putting them well into the black.

Basically, the firm cycles through hundreds of applicants, trying to find more stars like him.

Over the two weeks I tracked his P&L, he never had a losing day (and was pulling in about $10,000-30,000 a day).

He traded the 30 year bond and nothing but it. His average gain per trade was one third of a tick.

I'd say your assessment is probably correct. It seems there are a few hawks that accumulate the loses of the masses.

I just wanted to say it was wrong of you to hack my accounts in order to "prove" yourself and like the testimonial says...'Thanks a lot ***hole!!!'

Just kidding and keep the posts coming.

Changing passwords

-a

Just kidding and keep the posts coming.

Changing passwords

-a

I believe your results, why would you lie about a thing like that. Keep up the good work!! With all your money do you honestly need google ads? I have a new web site called blockgoogleads.com, it is like tivo for the web.

very nice accounts, i use amtd and scottrade as well to trade, use scottrade more due to their low cost of only $7.00 a trade, i am however thinking of switching it to mbtrading, where up to 500 shares its $5.00. I usually only trade between 100-1000 shares, nothing more. Besides that, that is very impressive, my question is how come you dont get a job at some hedgefund or financial firm, if you can show them proof of how well your stock picks are and how well the returns look im sure they would hire you in a second. Im sure with those kinds of numbers you could easily bank 6 or more figures a year.

Question

How come you dont trade stocks like EBAY, JPM, UTX, GLD, INTC, SMH, BBY, AEOS, SPLS, XOM, HAL, etc etc. You know stocks that have tremendous cash flow and are known by millions of investors. Nearly all the stocks you have listed i have never really heard or traded. Is this why your portfolio has beaten the major averages so many years in a row?

Bob

Post a Comment

Question

How come you dont trade stocks like EBAY, JPM, UTX, GLD, INTC, SMH, BBY, AEOS, SPLS, XOM, HAL, etc etc. You know stocks that have tremendous cash flow and are known by millions of investors. Nearly all the stocks you have listed i have never really heard or traded. Is this why your portfolio has beaten the major averages so many years in a row?

Bob

<< Home