Wednesday, May 31, 2006

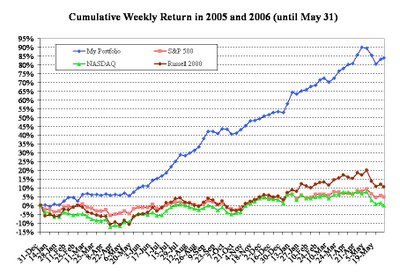

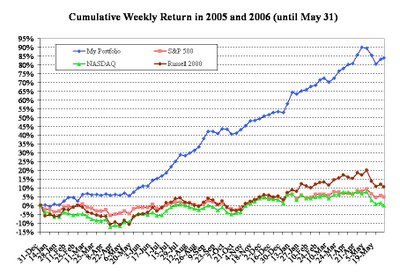

May Summary: S&P by a nose

Close but no cigar. I had a 0.2 percent lead against the S&P 500 going into today. However, despite the fact that my portfolio gained 0.5 percent for the day, the late day surge in the markets lifted the S&P by 0.8 percent, so I ended up slightly underperforming that index for the month. And what a lousy month it was. My portfolio lost 3.2 percent in May, the first major down month that I have experienced since the summer of 2004. I suppose it was inevitable. The one positive thing is that I did outperform the NASDAQ (down 6.2 percent in May) and the Russell 2000 (down 5.7). Of the three indices, The Russell really is the best benchmark against which to measure my performance, so I guess it could have been worse. Let's hope June is more profitable!

Tuesday, May 30, 2006

Thanks MARSA

It was another tough day for the market. As of the close of trading today, the NASDAQ is now below the level at which it closed 2004. Thanks largely to a nice move in MARSA/B, my portfolio lost only 0.1 percent for the day. I've now resigned myself to the fact that my portfolio will be down big for the month of May. My goal now is to at least outperform the S&P 500 for the month. With one more trading day in May remaining, I'm 0.2 percent ahead of that index. Hopefully I'll be able to hold the lead tomorrow.

Saturday, May 27, 2006

Weekly Summary: A Modest Recovery

The portfolio managed to gain $10,598 (1.5 percent) for the week, slightly edging out the S&P 500 (up 1.0 percent), the NASDAQ (up 0.8 percent), and the Russell 2000 (up 1.0) percent. I added a couple of new stocks to my portfolio: LTON and TOA. I think both are technically oversold and I will be looking to take a quick profit on them when (if I am right) they bounce.

A reader left a comment asking me to highlight which stock in my portfolio I like the most. That's a tough question, and the answer depends in part on one's time horizon. However, if you locked me up in a hatch on some crazy South Pacific island for a year and I could only retain one stock in my portfolio, I wouldn't hesitate in choosing DYNT.

A reader left a comment asking me to highlight which stock in my portfolio I like the most. That's a tough question, and the answer depends in part on one's time horizon. However, if you locked me up in a hatch on some crazy South Pacific island for a year and I could only retain one stock in my portfolio, I wouldn't hesitate in choosing DYNT.

Wednesday, May 24, 2006

Can't catch a break

Today was more or less the opposite of yesterday. My portfolio declined 1.0 percent while the broader market moved higher. As before, I continue to shuffle the deckchairs on the Titanic. I jettisoned a few stocks that I only marginally liked: RSC, DECT, and BOSC. I'll use the cash to increase my positions in the more attractive stocks in my portfolio.

Tuesday, May 23, 2006

Oilgear

Up 1.1 percent today. I picked up 1600 shares of Oilgear. OLGR is in a great industry, is solidly profitable, and has a catchy company name and ticker symbol. Like many energy and commodity stocks, it got hit hard over the past week. I think the stock is wildly undervalued. When the company reports next quarter's earnings, chances are they will show continued strong operating earnings and an increased backlog. On top of that, the company should report non-recurring profits of about $7 million from the sale of its Leeds headquarters. I'm in this stock for the long haul. I think it hits $20 before the end of the year.

Monday, May 22, 2006

Stepping up to the plate

The punishment continues: my portfolio was down another 0.9 percent today. I must admit this sell-off has turned out to be much deeper than I thought it would be. Indeed, I'm kicking myself for not trying to mitigate my losses by shorting some of the speculative commodity stocks that had run up so much in the last few months. Well, hindsight is always 20/20 I suppose. Fortunately, I am seeing more bargains out there than I have in a very long time. As such, I'm slowing increasing my exposure to the market. I got back together with a few ex-girlfriends today (GV and AE). I made serious money in both these stocks in the past and I'm hoping to get lucky again. I also started a new position in FRD, a stock that I think is now seriously oversold.

Weekly Summary

Another tough week: my portfolio declined a whopping $20,264 (2.8 percent), underperforming all the major indices. While I continue to tweek my positions, I still don't see a major reason to change the underlying trading strategy that has worked so well for me for so long. Let's hope this week is more profitable!

Wednesday, May 17, 2006

Capitulation

Another horrible day: the portfolio was down 1.5 percent. The good news is that I think we may have hit bottom today. All my watch lists were red across the board. This suggests that there was capitulation as many small investors threw in the towel. I know there's a common perception that you shouldn't try to outsmart the market, that one should just go with the trend. I think that's plain wrong. The bulk of empirical evidence suggests that there is very little correlation week to week among the major indices. In fact, there is evidence that one could profit by buying the dips. In the meantime, I continue to use my spare cash to add to some of my favorite positions (such as DYNT, a position to which I added 6000 shares today)

Tuesday, May 16, 2006

Out with MRM

Up 0.3 percent today. I sold my remaining shares of MRM. I've been holding this stock for nearly two years and it's barely budged. Today's lackluster earnings report just proves to me that this company is a mascot for mediocrity and I'm better off putting money elsewhere.

Monday, May 15, 2006

Down again

Another lousy day: down 1.5 percent. My portfolio is now down 3.7 percent from its all time high. This is the largest drawdown that my portfolio has experienced in nearly two years. Obviously, I am not happy with the fact that I've lost more than $27,000 in less than two weeks. Nevertheless, I don't see any reason why I should alter my basic smallcap value based strategy. It's worked well in the past, and I suspect when the dust has settled, it will continue to work in the future.

Saturday, May 13, 2006

Weekly Summary: Buying Opportunity

Another tough week for the portfolio: down $14,885 (2.0 percent). However, unlike last week, my portfolio outperformed the S&P 500 (down 2.6 percent), the NASDAQ (down 4.2 percent) and the Russell 2000 (down 5.0 percent). I know many of you are scared by how much the market dropped over the past few days. Don't be. If your view isn't "I eat corrections like this for breakfast" then you probably haven't been in this market very long. If you were smart, you would had used the strength of the market over the past few months to build a nice cash position, which would position you well to pick up shares from all the panicky investors out there. While I continue to keep a defensive posture and will keep my buying limited, I do intend to use any further weakness in the market to add to some of my favorite positions.

Thursday, May 11, 2006

Tough week so far

I'm still in Asia but will be returning home in a few days. The weakness that my portfolio experienced last week has carried over to this week. Although the damage so far has not been overwelming (down 1 percent so far this week), I am obviously concerned about the general weakness in so many of my positions. Quite simply, almost nothing is working. Most of my positions are either stagnant or slowly sinking. As best I can, I'm taking a defensive posture. I sold STRC Tuesday morning after the company reported a lousy quarter. Right now, I have a cash position of about $100K, which is helping to buffer my losses. Hopefully things will turn up a little over the next few days.

Saturday, May 06, 2006

Weekly Summary: Tormented

It was a truly pathetic week for my portfolio: down $2,377 (0.3 percent), substantially underperforming the NASDAQ (up 0.9 percent), the S&P 500 (up 1.2 percent), and the Russell 2000 (up 2.3). The main culprits were uninspiring earnings reports from companies like CBTE, KTCC, DYNT, and of course, the latest addition to my portfolio: TORM. Thankfully, nice moves in GV (a position that I have now closed), OCCF, and ACY helped offset some of the damage. Hopefully next week will bring better luck.

Thursday, May 04, 2006

Rolling the dice on TORM

While the rest of the market surges, my portfolio is getting beaten, battered, and bruised. What to do? How about a little gamble on an earnings play? TORM will be reporting earnings in a few hours. I put 6500 shares on black. Big money, big money, no whammies! I am disregarding the fact that the word "tormented" is the first word I think of when I read TORM. Anyway, it's bedtime for bozo. Over and out.

Monday, May 01, 2006

At least my watch list is doing well!

I checked my portfolio this morning (Asia time) only to discover that it was down about $5000 (0.7 percent) overnight. Yikes. I noticed that ELSE went bonkers over the past week. I kept toying with the idea of buying this stock when it was at $4 but never did. Oh well, I guess that is one more fish that evaded my net.