Friday, September 01, 2006

Weekly Summary: Good, but not good enough

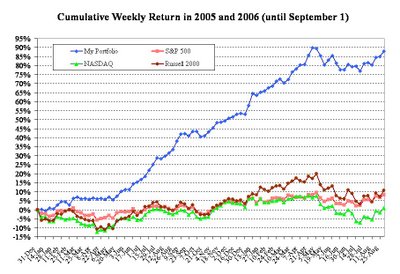

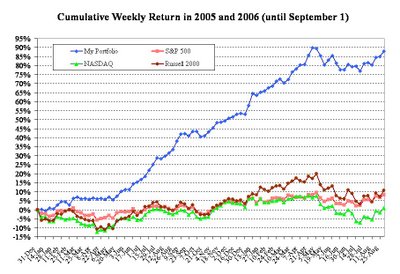

My portfolio gained $11,295 (1.6 percent) this week. While that's nice money any way you slice it, I did underperform both the Nasdaq and the Russell 2000 this week and also for the month of August. There is certainly truth to the old adage that a rising tide lifts all boats. As the graph below illustrates, my portfolio has continued to recover along with the rest of the market and is now only 1 percent off its all time high. Still, the days when I was beating the major indices on average by 5 percent per month seem to be a distant memory. Obviously, that's a margin of victory that would have been nearly impossible to maintain indefinitely in any case. Nevertheless, I am determined to keep working hard to ensure that I outperform the markets on a sustained basis. Have a great weekend everyone!

Comments:

<< Home

Coach, whats your take on EWEB now after the new development on Friday. Do you read something more then the news reported?

I sold YIWA for a tax loss. I have no clue what's going on there. No reporting, no financials, no website. I can only assume that the whole company was a scam. Live and learn!

About EWEB, this is my biggest loss of the year. I know they keep changing business models every month (hey, maybe in October they'll go into oil drilling). But my experience with cash rich companies like EWEB is that they do bounce back, so I'm sticking with it.

About EWEB, this is my biggest loss of the year. I know they keep changing business models every month (hey, maybe in October they'll go into oil drilling). But my experience with cash rich companies like EWEB is that they do bounce back, so I'm sticking with it.

Where is the SEC and Elliot Spitzer when it comes to companies like YIWA or maybe even EWEB? They have really dropped the ball.

They prefer to go after large companies over minor technical violations when there is MUCH more outright fraud perpetrated by microcap companies.

They prefer to go after large companies over minor technical violations when there is MUCH more outright fraud perpetrated by microcap companies.

Quant, you are absolutely right about companies like YIWA. I bought the company when it was fully reporting to the SEC, so the SEC did have obligations to protect small investors.

Post a Comment

<< Home