Monday, October 23, 2006

Buy and hold?

The week was off to a rocky start with my portfolio losing 0.2 percent today.

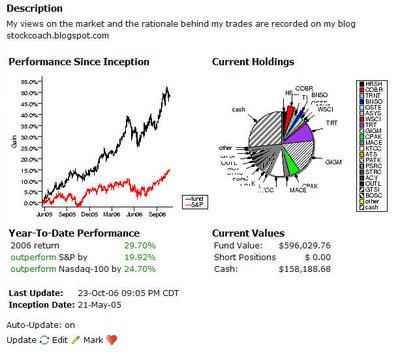

Back in May of last year, I entered all my positions at Openportfolios.com, a site that allows users to create model portfolios that are viewable by the public. I haven't touched that portfolio since because I wanted to see what would happen to it if I didn't adjust any of the positions. Here's where things would stand (click to enlarge):

Looking only at 2006, if I still had exactly the same portfolio now that I had in May 2005, my return would have been 29.7 percent so far this year, virtually identical to what I actually earned. In fact, the passive portfolio would have won out because by now, all those gains would be long-term and so I would have a lower accrued tax liability (not to mention that I wouldn't have needed to spend all that time actively managing my portfolio).

However, things aren't so simple. Just by looking at the pie chart, I can see that much of this year's gain would have come from one stock: GIGM. GIGM is one of those stocks that I obviously sold way too soon, a stock that will forever sit in my pantheon of "I kick myself whenever I see how high the price is now" stocks like SINA, SOHU, and JCOM. Also, active management certainly did help things between May and December 2005, when my actual portfolio gained about 47 percent compared to the passive portfolio, which gained only 15 percent (although that 15 percent may be too low because I am not sure how Openportfolios handled OUTL and PSRC, two stocks that got bought and are no longer publicly traded).

At any rate, taking a long-term approach, I don't think there is any way that I could have chosen a portfolio that would have gained over 1400 percent since November 2000. So, on balance, I think active management for me is the preferred strategy over a simple buy and hold approach. However, it is clear that in order to profit from such stocks as GIGM, I really do need to let my winners run more.

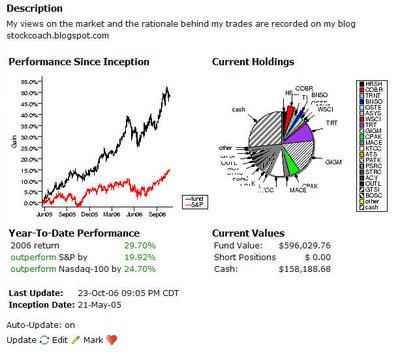

Back in May of last year, I entered all my positions at Openportfolios.com, a site that allows users to create model portfolios that are viewable by the public. I haven't touched that portfolio since because I wanted to see what would happen to it if I didn't adjust any of the positions. Here's where things would stand (click to enlarge):

Looking only at 2006, if I still had exactly the same portfolio now that I had in May 2005, my return would have been 29.7 percent so far this year, virtually identical to what I actually earned. In fact, the passive portfolio would have won out because by now, all those gains would be long-term and so I would have a lower accrued tax liability (not to mention that I wouldn't have needed to spend all that time actively managing my portfolio).

However, things aren't so simple. Just by looking at the pie chart, I can see that much of this year's gain would have come from one stock: GIGM. GIGM is one of those stocks that I obviously sold way too soon, a stock that will forever sit in my pantheon of "I kick myself whenever I see how high the price is now" stocks like SINA, SOHU, and JCOM. Also, active management certainly did help things between May and December 2005, when my actual portfolio gained about 47 percent compared to the passive portfolio, which gained only 15 percent (although that 15 percent may be too low because I am not sure how Openportfolios handled OUTL and PSRC, two stocks that got bought and are no longer publicly traded).

At any rate, taking a long-term approach, I don't think there is any way that I could have chosen a portfolio that would have gained over 1400 percent since November 2000. So, on balance, I think active management for me is the preferred strategy over a simple buy and hold approach. However, it is clear that in order to profit from such stocks as GIGM, I really do need to let my winners run more.